Bitcoin Halving 2024

This material does not constitute a call to trade, trading advice, or recommendation and is intended for informational purposes only.

On April 24 this year, the next Bitcoin halving will occur. You will find out what it is, why it happens, how it impacts the digital currency market, and more in the sections below.

Read this article by FBS analysts to know more about the process and prepare for the upcoming Bitcoin halving 2024.

What is Bitcoin halving?

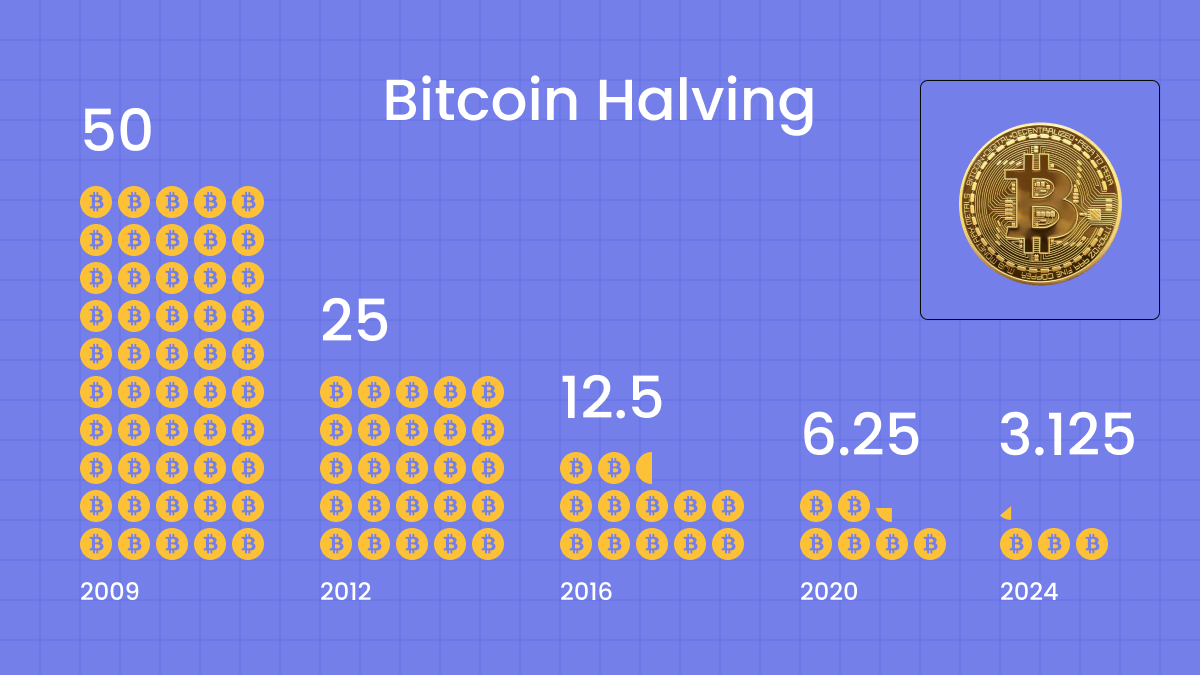

The Bitcoin halving is a significant event that occurs roughly every four years or after the completion of 210,000 blocks. The process results in a 50% reduction in the mining reward. Halving Bitcoin is designed to slow the rate at which new Bitcoins are introduced.

This will continue until the total supply approaches the 21 million coin cap, around 2140. With approximately 19.5 million Bitcoins in circulation as of October 2023, the approach to this cap underscores Bitcoin's scarcity and deflationary nature, ultimately shifting miners' incentives toward transaction fees to maintain network security.

Why does Bitcoin halve?

Bitcoin halving is a fundamental feature of Bitcoin's protocol designed to control its supply and simulate scarcity, similar to precious metals. The key goals of the process include:

- Supply limitation. This ensures a gradual approach to Bitcoin's maximum limit of 21 million coins, making it scarcer over time.

- Fighting inflation. Reducing the rate at which new Bitcoins enter circulation is a deflationary measure that preserves value against fiat currency inflation.

- Encouraging network security. As the rewards from mining decrease, transaction fees become more important, providing a continued incentive for miners to maintain network security.

- Long-term value boost. Halving of the BTC tends to increase market attention, leading to potential price spikes due to anticipated reduced supply.

As a result, halving underscores Bitcoin's scarcity, incentivizes network security, and supports its value appreciation.

How does a Bitcoin halving work?

Bitcoin halving decreases the mining reward for Bitcoin transactions, slowing the rate at which new Bitcoins are created and put into circulation. These events are scheduled to occur every 210,000 blocks, approximately every four years, and are expected to continue until the 32nd halving in around 2140.

Halving is integral to Bitcoin's design as it provides a controlled supply and emulates the scarcity store of value similar to precious metals.

What happened during the last Bitcoin halving?

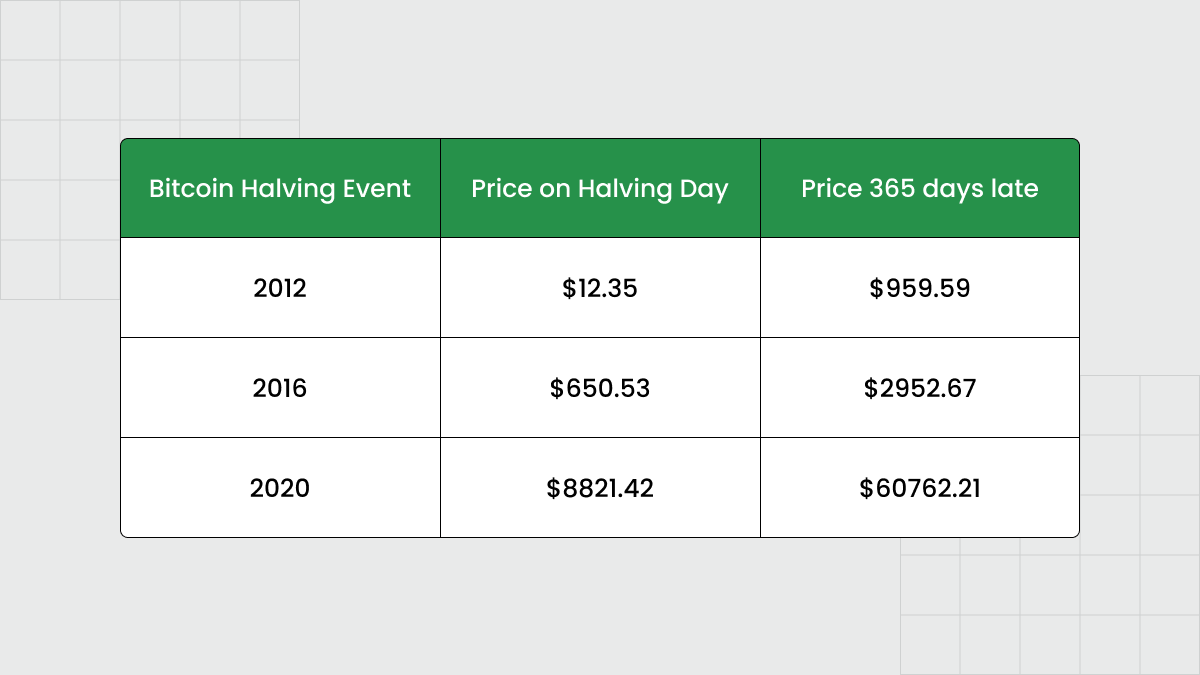

The BTC price during the halving and 365 days later

The recent Bitcoin halving took place on May 11, 2020. It was a significant turning point for the cryptocurrency, reducing mining rewards from 12.5 to 6.25 Bitcoins per block. This change in supply dynamics paved the way for a bullish trend that pushed the BTC value up from $6,877.62 on April 11, 2020, one month before the halving, to $8,821 at the time of the event. Despite some volatility, the price of Bitcoin continued to rise over the next year, reaching $49,504 by May 11, 2021.

This post-halving price increase is consistent with the trends observed after the 2012 and 2016 halves, where the most significant periods of growth occurred after the events.

Although there was a substantial drop in value approximately 12-17 months after each halving, the price stabilized well above pre-halving levels, underscoring the positive impact of the halving events on Bitcoin's long-term value.

Trading the Bitcoin halving

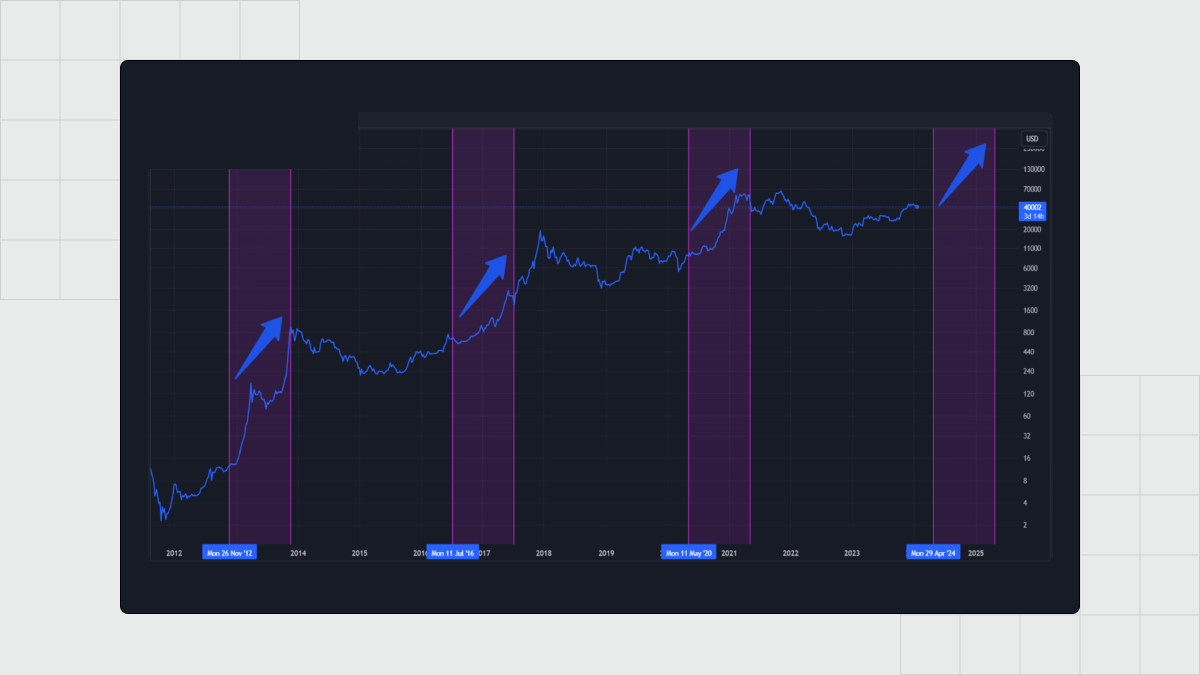

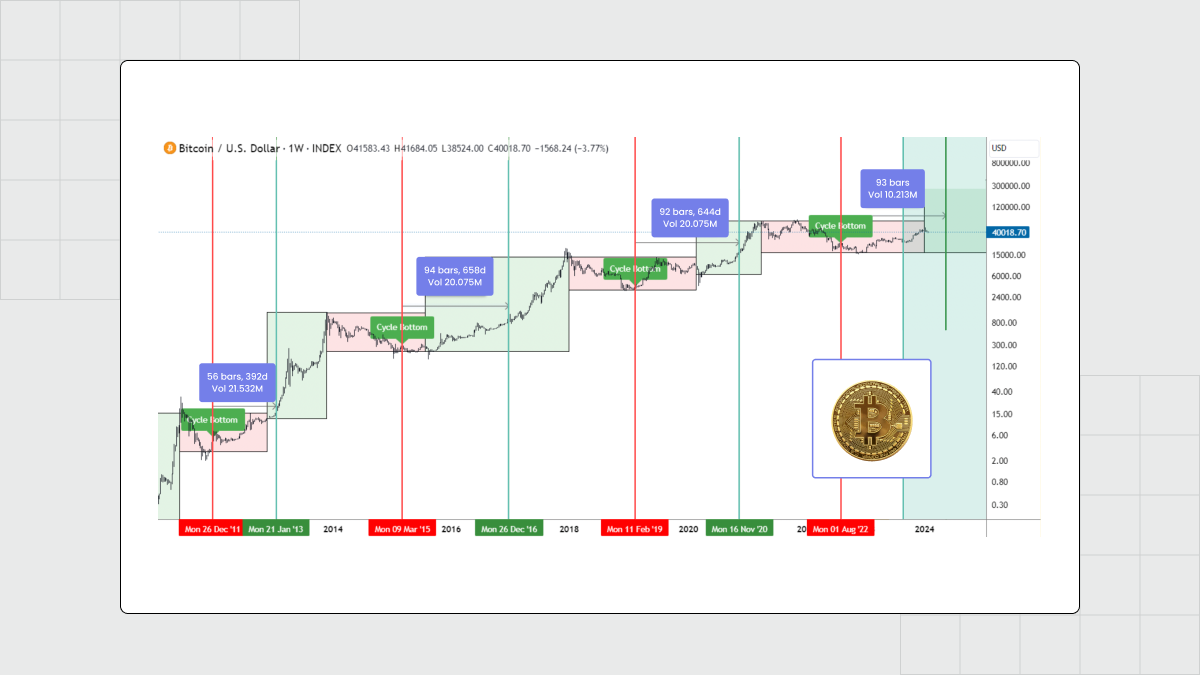

2012, 2016, and 2020 halvings and subsequent 12-month bullish trend

Price surges are often observed six to twelve months post-halving, allowing traders to build strategies for medium to long-term gains rather than immediate profits.

Effective Trading Strategies for Bitcoin Halving include:

- Long-term Holding (HODLing). Historical trends suggest that holding BTC through the halving could yield significant returns, as the value of Bitcoin tends to increase as the supply decreases.

- Using technical analysis. Technical analysis helps to identify the best times to buy and sell. Key indicators and patterns can warn of rising volatility associated with the halving.

- Portfolio Diversification. This approach serves as a hedge against market unpredictability. Diversifying investments across cryptocurrencies and other asset classes mitigates the risk of halving-induced price volatility.

- Informed Trading. Staying on top of market trends and global economic indicators is critical. Investor sentiment, regulatory updates and economic developments can have a significant impact on the market value of BTC.

It's safe to say that a strategic blend of historical insight, market analysis, and awareness of current events is essential to navigating the Bitcoin halving. This approach allows traders to manage market volatility and optimize the potential benefits of BTC halving.

When is the next Bitcoin halving date?

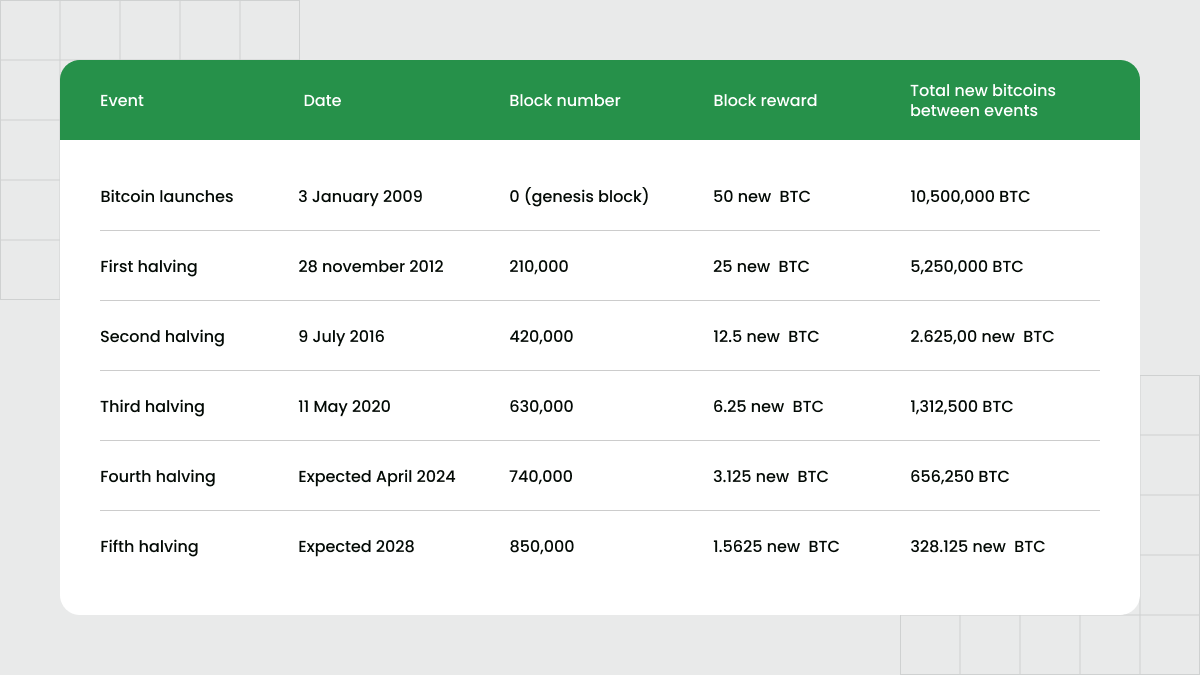

Table of previous and upcoming Bitcoin halvings

Table of previous and upcoming Bitcoin halvings

The Bitcoin halving 2024 will occur around April 2024. The event will coincide with the blockchain reaching the 740,000 block milestone. The 2024 halving will represent a pivotal moment in the digital currency evolution, underscoring the systematic approach to managing its supply.

Having already experienced three significant halves in 2012, 2016, and 2020, Bitcoin demonstrates a carefully planned supply strategy. These milestones serve as a testament to Bitcoin's innovative supply mechanism and shed light on how block discovery rates' intricacies can impact future halving timing. This dynamic underscores Bitcoin's enduring appeal as a subject of intense scrutiny and speculation in the financial world and highlights its distinctive role in the broader economic landscape.

Bitcoin halvings: key events

How the BTC price changes over time after halving

The Bitcoin halving, occurring approximately every four years or after the completion of 210,000 blocks, is a crucial event with far-reaching implications for the cryptocurrency ecosystem. Its immediate impact on mining and its enduring influence on Bitcoin's price and market perception make it a significant milestone in the digital currency's history. Understanding the technical intricacies and historical ramifications of these halving events is essential for comprehending why they are considered bullish for Bitcoin.

Historically, halving events have been associated with substantial bullish trends in Bitcoin's price. This trend can be attributed to the fundamental economic principles of supply and demand. When the mining reward for new blocks is halved, the rate at which new Bitcoins are generated decreases. Consequently, with a reduced supply growth rate and assuming constant or increasing demand, the price of Bitcoin is likely to experience an upward trajectory. This pattern has been observed in the aftermath of previous halving events, indicating a consistent correlation between halving and positive price movements.

The halving holds significance for Bitcoin's long-term value for several compelling reasons. Firstly, it underscores Bitcoin's inherent scarcity. With a finite supply cap of 21 million coins, each halving event brings Bitcoin closer to its maximum supply, enhancing its scarcity and potential value per unit.

Furthermore, halvings underscore Bitcoin's deflationary nature, starkly contrasting to fiat currencies that are susceptible to inflation through unlimited money printing by governments and central banks. Bitcoin's predictable supply schedule and diminishing issuance rate position it as an appealing hedge against inflation and a reliable store of value over the long term.

Bottom line

The Bitcoin halving 2024 is a long-awaited event that reflects the cryptocurrency's unique approach to managing its supply and highlights its scarcity. The halving mechanism sets Bitcoin apart from fiat currencies by providing a predictable and controllable supply reduction strategy, ensuring its long-term value and appeal.

As we approach the 2024 halving, the cryptocurrency community is closely monitoring the potential impact on the Bitcoin price, the mining ecosystem, and overall market dynamics.

Halving events are critical to boosting Bitcoin's price and market perception, and the scarcity caused by these events has fueled bullish trends in the following months. For investors and traders, understanding the implications of halving is critical to strategizing and navigating the cryptocurrency market.

Keep a close eye on BTC-related events with FBS and make yourself ready to profit during the upcoming 2024 halving. Learn more about trading Bitcoin and other cryptos using news and free educational materials provided by FBS.

FAQ

When is the next Bitcoin halving in 2024?

The Bitcoin halving 2024 is expected to occur in April. The 2024 halving will reduce the block reward for miners by half, leading to a decrease in the rate at which new Bitcoins are created.

Will BTC go up after halving?

The historical trend suggests that the 2024 halving could trigger a price spike, as has happened after previous halving events. However, it's important to note that past performance is not indicative of future results, and the price of Bitcoin is influenced by a variety of factors.

When exactly is Bitcoin halving?

The upcoming Bitcoin halving 2024 is expected to take place on April 24. As a result, the supply of new Bitcoins coming into circulation will decrease, which can potentially lead to a decrease in selling pressure from miners. Bitcoin halving has been associated with increased scarcity and a subsequent increase in the price of Bitcoin, as the reduced supply often leads to increased demand.

The halving event is an important part of Bitcoin's monetary policy, designed to gradually reduce the rate at which new Bitcoins are created, ultimately leading to a maximum supply of 21 million Bitcoins.

Is halving good for crypto?

The halving of BTC is generally seen as a positive event for the cryptocurrency, as it reduces the rate at which new Bitcoins are created, leading to increased scarcity. This scarcity can potentially increase demand, which in turn can increase the value of Bitcoin. Other positive factors of BTC halving include: predictability, long-term sustainability, increased market attention, pushing the industry towards a healthier and more sustainable mining ecosystem.